Asian shares dipped Friday and U.S. futures had been regular as a world fairness rally paused. Sovereign bonds held good points after traders scaled again expectations for monetary-policy tightening to quell inflation.

Shares fell in Japan and Hong Kong, the place developer Kaisa Group Holdings Ltd. and its Hong Kong-listed items had been suspended from buying and selling within the newest signal of stress from China’s troubled property sector. S&P 500, Nasdaq 100 and European futures fluctuated after tech shares led Wall Street to a document excessive.

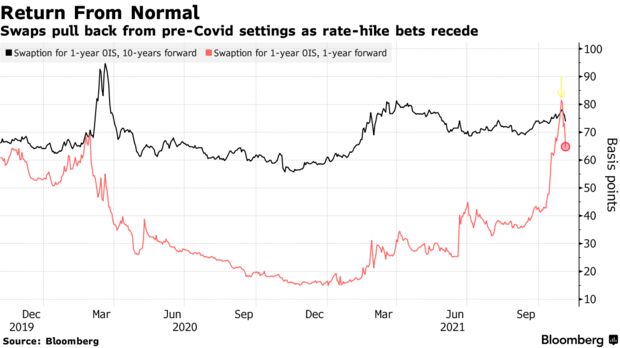

Treasuries and the greenback held a climb. A shock Bank of England transfer to carry rates of interest spurred a world surge in bonds as traders reviewed the outlook for borrowing prices. Interest-rate futures had priced in two quarter-point Federal Reserve will increase in 2022 however shifted the second towards 2023. Jerome Powell this week stated the Fed could be affected person on hikes.

Crude oil superior. Saudi Arabia and its OPEC+ allies rebuffed U.S. President Joe Biden’s pleas for a big manufacturing increase. That leaves Biden with the choice of tapping the U.S. strategic reserve.

The focus turns to the U.S. jobs report due Friday for the reason that degree of progress on employment might shift views on financial coverage once more, heralding additional volatility within the bond market. Stocks are using out such gyrations up to now: stable U.S. earnings seem to have reassured traders that the financial restoration can climate pandemic-related provide chain and labor disruptions.

“You have to stay away from bonds at the moment,” Nancy Tengler, chief funding officer at Laffer Tengler Investments, stated on Bloomberg Television. While there’s a “little bit of a rally going on” in fastened earnings, “it’s difficult to see a way clear to make a lot of money, especially when real rates are negative,” she stated.

Elsewhere, Australia’s central financial institution in a quarterly replace of forecasts dismissed the prospect of a price enhance within the subsequent 12 months, additional pushing again in opposition to market expectations of a tightening cycle beginning subsequent 12 months.

Meanwhile, China’s authorities bonds had been set for his or her greatest weekly advance since July after the nation’s central financial institution elevated its injection of short-term money.

The newest U.S. knowledge confirmed unemployment advantages fell to the bottom since March 2020. Friday’s employment report is forecast to indicate nonfarm payrolls rose by 450,000 in October. Traders are more likely to be careful for wages development.

“The narrative around wage growth and very strong job creation suggests to me we are nowhere out of the woods in seeing higher bond yields going into next year,” Sean Darby, chief world fairness strategist at Jefferies, stated on Bloomberg Television.

- U.S. unemployment, nonfarm payrolls, Friday

For extra market evaluation, learn our MLIV

weblog.https://imasdk.googleapis.com/js/core/bridge3.487.0_en.html#goog_814074595StanChart’s Gill on Bonds, CommoditiesManpreet Gill, Head of FICC Strategy at Standard Chartered Private Bank, discusses his outlook for bonds and commodities. He speaks with David Ingles and Yvonne Man on “Bloomberg Markets: China Open”.

Stocks

- S&P 500 futures had been regular as of 6:50 a.m. in London. The S&P 500 rose 0.4%

- Nasdaq 100 futures had been flat. The Nasdaq 100 rose 1.3%

- Japan’s Topix index shed 0.7%

- Australia’s S&P/ASX 200 index added 0.4%

- South Korea’s Kospi fell 0.5%

- Hong Kong’s Hang Seng index was 1.4% decrease

- China’s Shanghai Composite index fell 1%

- Euro Stoxx 50 futures had been flat

Currencies

- The Bloomberg Dollar Spot Index was regular

- The euro was at $1.1556

- The Japanese yen was at 113.64 per greenback, up 0.1%

- The offshore yuan was at 6.4002 per greenback

Bonds

- The yield on 10-year Treasuries rose about one foundation level to 1.54%

- Australia’s 10-year bond yield fell two foundation factors to 1.81%

Commodities

- West Texas Intermediate crude rose 0.7% to $79.35 a barrel

- Gold was at $1,796.53 an oz., up 0.3%