China’s transformation from a financial-technology backwater right into a $46 trillion-a-year international chief in digital funds left most worldwide buyers watching in awe from the sidelines. Now India is present process its personal fintech revolution, and the race is on to seize a chunk of the motion.

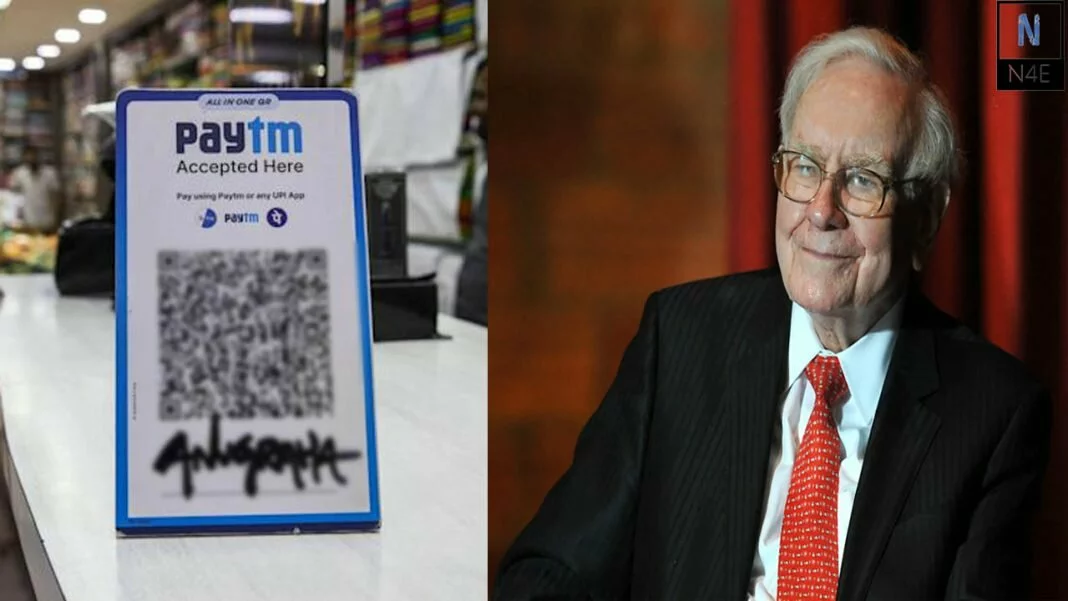

As on-line funds and digital loans within the second-most populous nation soar at a number of the quickest charges worldwide, cash is pouring into India’s monetary expertise sector at an unprecedented tempo. The sector’s sharp ascent will likely be on present this month as Indian funds agency Paytm — backed by overseas heavyweights together with Warren Buffett’s Berkshire Hathaway Inc., China’s Alibaba Group Holding Ltd. and Masayoshi Son’s TenderBank Group Corp. — seeks a valuation of about $20 billion in what can be India’s largest ever preliminary public providing.

Some overseas gamers in India are poised to see payoffs. Berkshire Hathaway, which invested $300 million in Paytm in 2018 for an almost 3% holding might see the worth of its stake rise about 70% at a $20 billion valuation, whereas Paytm’s different worldwide backers would additionally revenue. Investment banks together with Goldman Sachs Group Inc. — which is engaged on Paytm’s IPO — have been bolstering their groups within the nation and are benefiting from the spate of offers and the flurry of fund elevating.

The investor fervor is being fueled by tens of millions of Indian customers like Nitu Gore, a maid in Mumbai who earns about $2,700 a yr and hadn’t used her checking account in a decade. She embraced Google Pay and Paytm through the pandemic and now depends on the apps for nearly all of her purchases, a dramatic shift in an financial system that’s dominated by money.

Digital retail funds on India’s Unified Payments Interface — the much-lauded nationwide fintech system that connects greater than 230 banks and 20 third-party apps — have risen almost fivefold over the past two years to 41 trillion rupees ($546 billion). Meanwhile, China’s ongoing fintech crackdown is just including to India’s attraction. Venture capital and personal fairness corporations have invested $6.4 billion up to now this yr in Indian fintech firms, triple the quantity their Chinese counterparts drew, in accordance with researcher Tracxn.

Local fintechs like Paytm — arrange by the small-town entrepreneur Vijay Shekhar Sharma who taught himself English listening to rock music — are becoming a member of Google Pay, Amazon Pay and Walmart Inc. owned PhonePe in going past digital funds and difficult conventional banks by venturing into the profitable enterprise of providing loans, mutual funds and even amassing deposits. The fintech corporations have some restrictions: Local corporations require them to tie-up with a lender or a regulated entity. However, armed with subtle cloud expertise and buyer information to evaluate danger profiles, fintechs have gotten the more and more dominant companions of lenders on this nation of 1.4 billion, serving to them attain newer prospects at an especially low value.

“What the government has done with the common fintech network in the form of the UPI is phenomenal,” Raghav Maliah, vice chairman of world funding banking at Goldman Sachs mentioned in an interview. “It’s the equivalent of the creation of the National Highway System in the U.S. and leads us to be very bullish on possible opportunities in India.”

The outsized progress of fintech in India has some involved that buyers who aren’t financially savvy might borrow an excessive amount of, driving requires extra oversight. There are additionally rising cases of on-line funds fraud that authorities are neither capable of examine or curb as there are far too many victims amongst first-time customers.

Yet optimists say India’s fintech business provides higher prospects for overseas gamers than China ever did. That’s thanks largely to the UPI, which was arrange by an umbrella of personal banks in 2016 with the help of India’s central financial institution and is now serving to to spur extra competitors as a result of quite a lot of monetary establishments can faucet into it.

Compared with China, which is overhauling almost each side of its fintech business because it cracks down on firms like Jack Ma’s Ant Group Co., laws in India have up to now been clear and predictable.

Indian fintech firms are more likely to appeal to an extra $3 billion to $4 billion of funding over the following 18 months as a result of tighter Chinese laws, in accordance with Anuj Kapoor, managing director for funding banking in UBS Group AG’s India enterprise.

“Overnight Chinese regulations on digital companies have dented the confidence of investors primarily in the digital technology sector,” Kapoor mentioned. “Clearly it has already started shifting investment sentiment positively towards India. More and more investors will look to India.”

India’s digital transactions are anticipated by PricewaterhouseCoopers to the touch $3 trillion by March 2025 from greater than $1.3 trillion now. At the center of the meteoric rise of the Indian business is the chutzpah of entrepreneurs like Paytm’s Sharma, who’ve needed to navigate the challenges of an unlimited nation with tens of millions of native shops, most of whom are new to accepting digital funds.

“You have to be far more Zen to survive in this country,” Sharma mentioned in a 2019 interview with Bloomberg Markets journal. “If you build in India, you can go build anywhere in the world. What do you think is the first thing an Indian kid learns? That the bus stop is not where the bus will stop.”

Investors like Ant and Softbank have mentioned they are going to promote shares within the Paytm IPO. Buffett’s assistant didn’t reply to a message looking for remark.

Even with funding from a mammoth IPO, which seeks to boost as a lot as $2.4 billion rupees, Sharma faces hefty competitors from international rivals like Google and Walmart. GooglePay and PhonePe management greater than 85% of the retail transactions on the UPI platform, helped partly by ease of use and cash-back provides to customers. Even so, Paytm has the most important share of India’s service provider funds market and in contrast to its rivals Google Pay, Amazon Pay and Phonepe, Paytm has the benefit of increasing its funds enterprise into monetary providers by means of its funds financial institution the place it will probably maintain buyer money balances. That ties effectively with its e-wallet, permitting it to supply loans and insurance coverage whereas being a market for flight tickets or electronics. In the fiscal yr ended March 2021, Paytm had income of 28 billion rupees and its losses narrowed to 17 billion rupees from 29.4 billion rupees the earlier yr.

The Paytm IPO will open for subscription on Nov. 8 and the inventory is anticipated to start out buying and selling later within the month.

India has about 825 million folks on-line through their smartphones, with lots of of tens of millions new to the Internet. The largest gamers in digital funds need to broaden into banking providers which have the potential to get them greater income.

Facebook is providing loans of as tiny as $6,720 to small companies by means of its community. Google Pay prospects can now immediately open a deposit with the native Equitas Small Finance Bank. Google is collaborating with fintech startup Setu to permit customers to open single-click fastened deposits at an rate of interest that betters these provided by giant banks. Amazon has signaled its entry into the wealth administration phase by investing in fintech startup Smallcase Technologies Pvt., and has additionally backed insurance coverage and lending startups.

“The success of UPI and digital payments has opened many new opportunities for the financial services industry to partner deeply with fintech players,” Sajith Sivanandan, Asia Pacific head of funds at Google, wrote in a latest weblog.

Meanwhile, a bunch of smaller native fintech startups have sprouted up, some like StuCred that provide scholar loans which can be as small as $11 and others providing 2-rupee insurance coverage cowl for cab rides. New Delhi-based fintech startup BharatPe has developed a common QR code system which permits retailers to just accept digital funds from prospects by means of a fee app of their selection. The adjustments are upending the normal banking sector. Commercial banks can win extra prospects rapidly, whereas saving on the prices of area brokers and branches. But they’re rising extra depending on fintech corporations for buying prospects.

India’s central financial institution already requires that each one sorts of lending be linked to a licensed regulated entity, which implies that digital lenders must tie up with a financial institution or a non-banking financier.

Still, digital lending in India is anticipated to rise to $350 billion by 2023, contributing about half of complete retail loans, as estimated by Boston Consulting Group. That’s growing the danger of cyber fraud and coercive assortment practices as some smaller fintechs goal financially weak prospects who can’t borrow from banks. Other downsides embrace over-borrowing by less-financially-savvy prospects.

“The highways have made the access easier but the lenders have been kept at the center of custodians of risk. That allows greater scrutiny over loans,” mentioned Vivek Belgavi, chief of the fintech follow at PwC India. But to maintain up with the lightning velocity of digital innovation, regulatory supervision must be strengthened even additional, he mentioned.

Despite the dangers, digital lending is a necessity in a rustic of 1.3 billion the place the World Bank estimates that solely about 10% of adults have entry to formal loans. India’s fintech growth is filling these and different gaps.

“I prefer getting my money in Google Pay and Paytm as I can also buy my groceries, vegetables using the QR codes at shops,” mentioned Gore, the Mumbai maid. “No one uses cash anymore.”