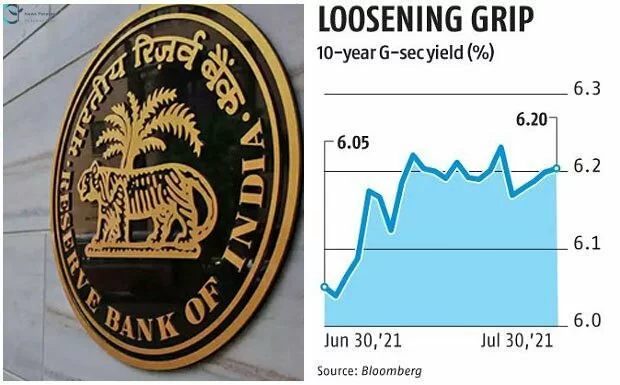

The Reserve Bank of India (RBI) is letting the 10-year bond yield align with market realities, forward of its financial coverage subsequent week.

This is a distinct technique than what performed out till final month, the place the central financial institution appeared extra targeted on retaining the 10-year bond yields at 6 per cent. The logic given by senior executives at the moment was that the 10-year bond has extra influence on all the yield curve and so the main target could possibly be disproportionately greater on the aspect of the 10-year bond.

However, bond sellers say that line of motion could have ended with the final benchmark 10-year bond, most of which ended up touchdown within the books of the RBI resulting from intervention.

The 10-year bond yields closed at 6.204 per cent on Friday. The new 10-year was launched on July 9 at 6.10 per cent, which itself was a excessive coupon provided to the market.

At the beginning of the month, the yield on the older benchmark was at 6.039 per cent. As bond costs fall, yields rise, and vice versa.

“The 10-year bond was trading at a premium earlier (yields were lower) due to RBI intervention. With little intervention RBI is now allowing 10 year to readjust with the yield curve,” stated Debendra Dash, senior vice chairman at SU SFB.

With this, the 10-year bond has once more garnered buying and selling quantity within the secondary market. The new benchmark is the third-most traded safety within the bond market, whereas the final benchmark was barely getting traded because the sixth most. The excellent in opposition to the newest benchmark is simply Rs 28,000 crore. As extra bonds are issued on the paper, the 10-year bond needs to be again as essentially the most traded safety out there, bond sellers say.

Light intervention warns speculators, and on the identical, helps the bond market mirror a real image of the economic system, stated bond sellers. But economists say the stress between the market and the RBI would proceed as each would attempt to check every others’ tolerance restrict.

“Yields are calibrating with the domestic growth-inflation dynamics, which is healthy. Though the global yields are reasonably benign, the resurgence of covid cases is an important factor to watch for,” stated Soumyajit Niyogi, affiliate director of India Ratings and Research.

However, the rise in yields forward of the coverage places some stress on the RBI. It needs to maintain yields low to help the federal government borrow at an affordable charge, however on the identical time, it has to maintain the home traders blissful at a time when the worldwide traders are withdrawing their debt funding from India. Since FY19, international traders have been internet sellers of Indian debt.

The bond market, subsequently, will keenly watch the coverage measures that the RBI would introduce within the coverage subsequent week. Generally, a liquidity normalisation measure could be bond market damaging, stated sellers.

“On both foreign exchange and G-Sec yield levels, the stated line of the RBI is that they let market forces play out, only that movements should be orderly. In G-Sec primary auctions lately, we are not seeing as much of devolvements or cancellations as we have seen earlier,” stated Joydeep Sen, advisor fastened earnings at Phillip Capital.

Earlier, the RBI generally refused to promote bonds. But not too long ago, it’s devolving the bonds on the first sellers. Which means underwriters of the auctions are being offered the bond, as a substitute of promoting it on to bidders. These bonds find yourself coming again to the market.

On Friday’s public sale, the RBI devolved Rs 7,465 crore of the benchmark 5-year bond, out of Rs 11,000 crore on supply. Overall, within the public sale, the RBI raised Rs 35,000 crore from the market.