Tata takeover: what happens when Tata buys a company

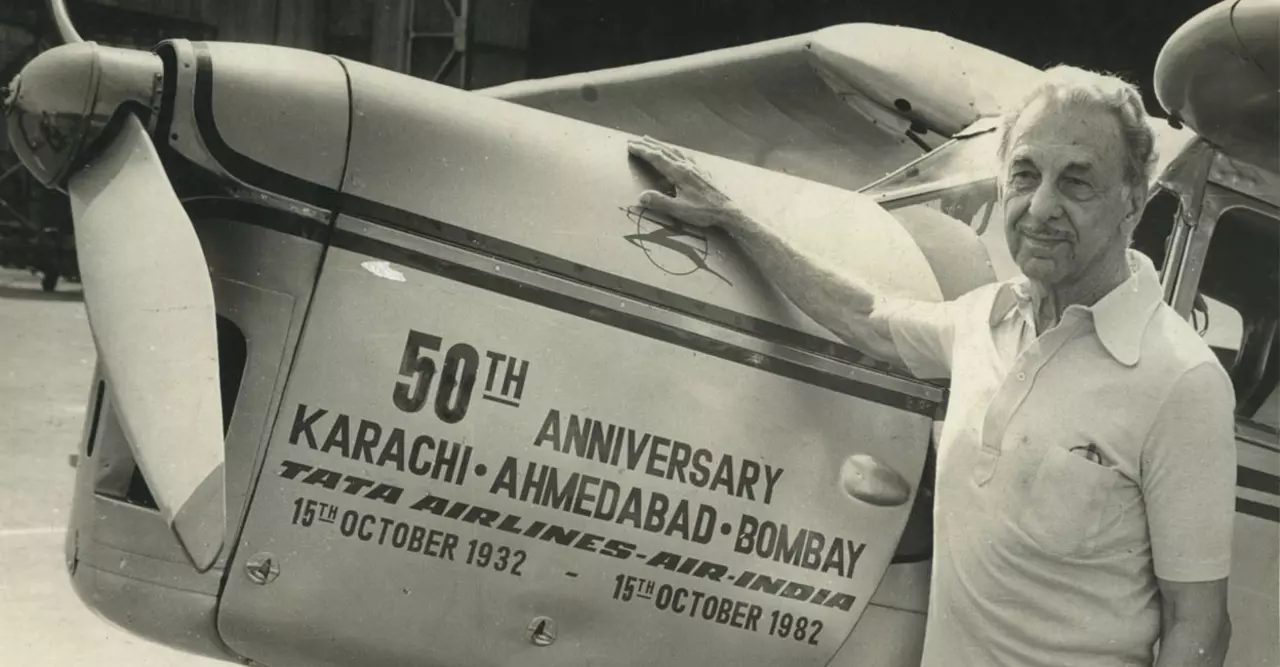

When you hear "Tata takeover" you might picture a big logo change and a CEO handshake. The reality is messier, slower and a lot more strategic. Tata Group has bought global names — Tetley (2000), Corus (2007), Jaguar Land Rover (2008) and most recently Air India (deal closed 2021–22) — and each deal shows a pattern: long-term bets, debt handling, and big operational fixes.

Why Tata goes for big buys

Tata often buys companies that bring scale, global brands or technology. They pick targets with strong market position but operational or financial problems. For example, Corus gave Tata Steel access to European markets; Jaguar Land Rover added premium auto know‑how; Air India brought a national carrier with routes and landing rights. Tata’s play is not quick flip — they invest in turnaround work: management changes, cost cuts, and brand rebuilding.

What to watch after a Tata takeover

After the headlines fade, three things matter most.

First, how Tata manages debt and cash. Many targets carry heavy debt; Tata either refinances, injects capital, or restructures loans. That determines how fast the company can modernize or expand.

Second, integration and culture. Global buys mean mixing teams across countries. Expect new reporting lines, training programs, and sometimes layoffs to remove duplicate roles. The goal is smoother operations, but the short-term pain can be real.

Third, customer experience and strategy. Tata often rebrands, updates products or improves service. With Air India, we saw fleet upgrades, a new loyalty plan rollout and plans to merge Vistara routes. For consumers, that can mean better service — and also fare restructuring.

Worried about jobs? If you're an employee, focus on skills and visibility. Companies require fewer duplicate teams after a takeover, so people who show cross‑functional skills and a willingness to adapt tend to stay. If you’re a customer, watch product changes and early offers; new owners want to keep revenue flowing while they fix fundamentals.

Investors and market-watchers should check three signals: capital spending plans, debt timelines, and leadership changes. Tata’s moves are usually conservative long-term bets, not short-term value plays. Many takeovers take years to show results.

What about regulators and politics? Big takeovers need approvals — competition authorities, foreign investment clearance, and sometimes government nods when national assets are involved. These steps add time and can reshape deal terms.

If you want a quick rule of thumb: Tata takeovers mean long-term intent, careful fixes, and often a brand revival. The early period is about stabilizing finances and operations; the later years are about growth and integration. That’s why these deals matter — they don’t just change owners, they remake how a business runs.

Curious about a specific Tata takeover? Mention the company and I’ll walk you through the likely timeline and what it means for workers, customers and the market.

How is Air India's trajectory after Tata's takeover?

Since Tata's takeover of Air India, the airline's trajectory has shown promising signs of improvement. The management has focused on enhancing customer experience, upgrading technology, and streamlining operations. Employee morale seems to be on the rise as well, as the new ownership brings a sense of stability and growth potential. Tata's vast resources and expertise in various industries are expected to aid in Air India's turnaround. Overall, the future looks bright for Air India under Tata's leadership, and it's exciting to see how the airline will evolve in the coming years.

View more